Accounting & Financial Management Made Easy

In today’s digital landscape, even the smallest business can benefit significantly from the right small business accounting software solution.

Accounting software greatly reduces human error in your calculations, allows you to track revenues, forecast sales, better manage your inventory and gain vital insights into your business so that you can make data-backed decisions.

In theory, the benefits of the right small business accounting software are limitless, as the ideal solution will grow and evolve with your business, becoming an integral part of every business, financial or marketing decision made.

The question is, how do you find the perfect accounting software – one that integrates seamlessly with your every business need?

Many accountants, bookkeepers and business owners we’ve spoken to have said that time-saving features, cost saving and ease of use are the top three qualities they look for in an accounting program.

Finding the right accounting software for your small business can be challenging, with so many options to choose from.

It’s important to keep in mind that your business needs will determine which accounting software will be the best fit for you.

To help you make the right choice, let’s break down some of the most important questions and considerations to keep in mind when searching for the best accounting software available:

Read on, or click below to easily jump to the sections that interests you most:

► Types of Accounting Software Products Available

► Quick Questions to Ask When Choosing Accounting Software

► Key Benefits of Business Accounting Software

► Understanding Your Accounting Needs

► Features

► Security – Is Software Secure

► Scalability – Will It Grow with My Business

Types Of Accounting Software Products Available

Entry-Level Billing & Invoicing Systems

Entry-level accounting solutions make it much easier for small businesses to complete their daily accounting tasks. Besides the time saving benefits, the main aim of these accounting solutions is to keep track of your finances and improve the accuracy of your accounting figures.

Invoicing and billing tools help document financial activity, while the speed and professional document creation improves brand credibility.

Small Business Accounting Software

Targeted at small to medium size businesses, these accounting solutions are hugely popular and are typically downloaded online and installed directly to your desktop computer – allowing for quick and efficient business accounting.

With standard accounting tools and reports, multi-user capabilities, ease of use features and the option of paid add-ons, these cost effective solutions are ideal starting points for any small to medium business.

Enterprise Resource Planning (ERP)

These business accounting software solutions go beyond that of the above mentioned small business accounting software products, providing more features and greater capabilities.

Targeted at larger medium enterprises and big business, and often marketed as complete solutions, ERP software typically brings with it inventory control, stock integration, point-of-sale systems, supply chain management, billing and purchasing.

Quick Questions To Ask When Choosing Accounting Software

> Is this accounting software a good fit for my industry?

> Does it offer all the features I require?

> Does the software have room to grow with my business?

> How many employees and clients will the software accommodate?

> How is my data backed up?

> What security measures are in place to keep mine and my client’s data secure?

> What is the total cost? Are there any hidden or additional costs?

> What types of tech support and customer service is provided?

> Is the accounting software locally developed?

> Will I be able to personalise and/or brand documents?

> How easy is it to export financial data and accounting reports?

> Is the software easy to use?

> Will it save me time and help eliminate human error?

Key Benefits Of Business Accounting Software

Software reviewers, FinancesOnline, break down the key benefits of business accounting software as follows:

- Simplification – putting financial control in the hands of a non-accounting audience

- Cost Saving – eliminate outsourcing costs and automate core calculations and administrative procedures

- Full Financial Transparency – avoid costly and recurring human errors

- Accurate Forecasting – visualise your financial data to make informed business decisions

- Increase Productivity – drill down into your business data to ensure efficient resource use

- Tax Compliance – tax-focused accounting reports store important details for maintaining a transparent workflow

- Improved Customer Relation – effective billing and invoicing, prevent delays and miscommunication, personalise business documents to spread brand awareness

- Security – build your internal security structure and control who has access to sensitive data

Understanding Your Accounting Needs

The first place to start when choosing an accounting software solution is with an evaluation of your business. This will help identify your specific accounting needs, allowing you to easily determine the main features required from the software.

In addition to basic accounting requirements, create a list of all the necessary features you want the software to handle, such as stock control, commission management, sales and purchase analysis data and more.

Consider the business industry that you represent and the vital requirements necessary to keep operations running smoothly. If possible, consult your accounting team or bookkeeper, as they’ll likely be more experienced in using the diverse types of software. They can advise you on whether your choice will be an ideal fit once integrated with your business.

It’s important to not only focus on current operations when choosing, but also consider the future of the business. An accounting software solution that fits perfectly today, may be outgrown a year from now. Keep business growth and software scalability in mind when drawing up your scope list.

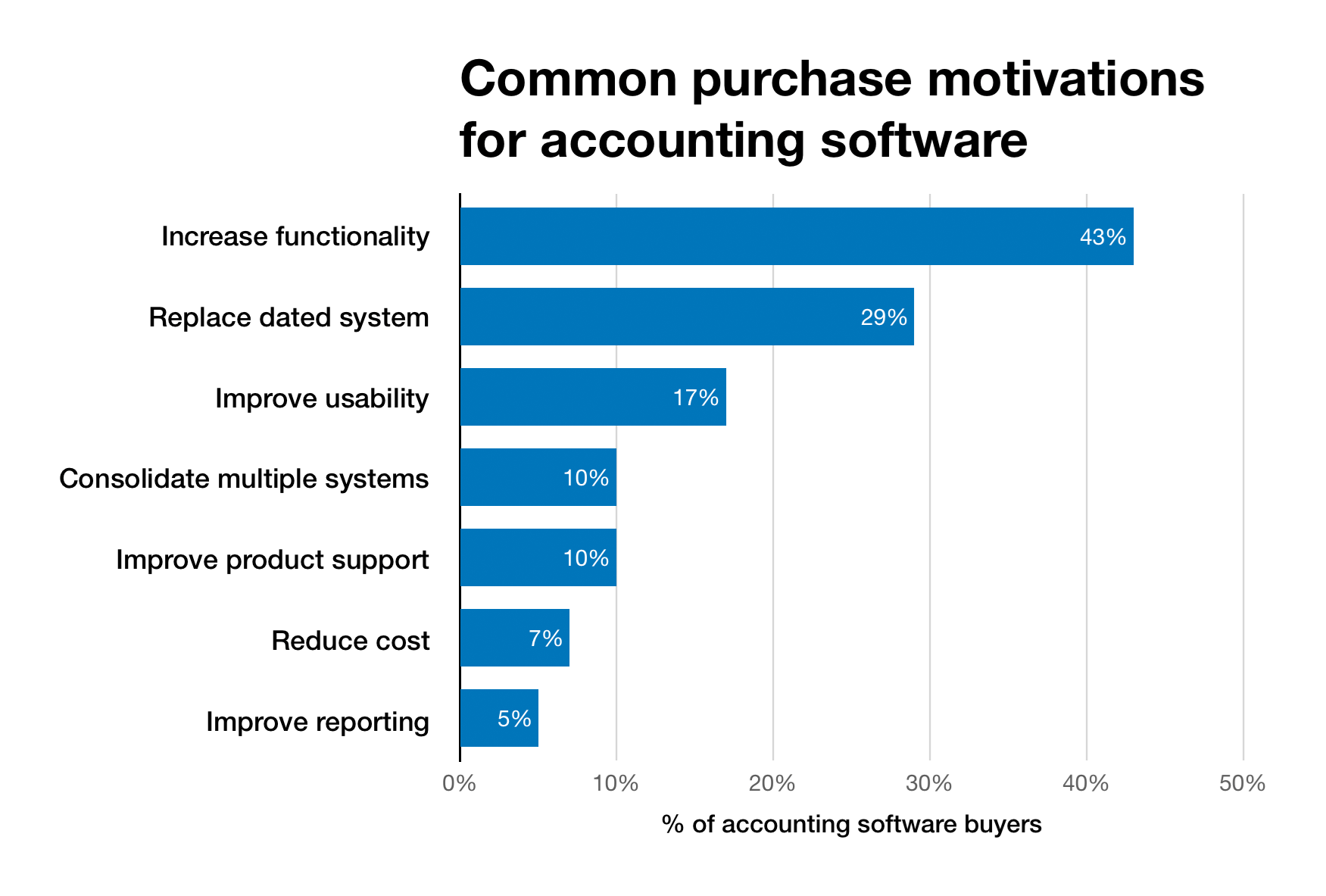

Software advisors, SoftwareConnect, analysed more than 3,000 accounting software projects in 2018 in order to discover the most common motivations for purchasing accounting software:

Features

Small business accounting software solutions offer many key features and useful tools to help you manage your finances.

By having a clear understanding of your accounting needs, you’ll be able to easily identify accounting software options that best match your requirements.

It’s important to remember though, that besides making it much easier to complete routine accounting tasks, the ideal accounting software should also allow you to better visualise your business data, providing a comprehensive “big picture” of the financial health and activity of your business.

After identifying an accounting package that covers your scope, explore which modules and features are included in the base price, and which require additional costs to unlock.

Here are a few common features you should look out for when choosing the best accounting software for your small business:

→ Create and Send Invoices – Customise Look and Feel

→ Track Expenses – Order by Category

→ Manage Accounts Payable & Receivable

→ Manage Inventory and Stock Control

→ Automated VAT Calculations

→ Record Journal Entries

→ View List of Customers and Suppliers

→ Multi-User Creation Capabilities

→ Multi-Company Creation Capabilities

→ Budget Forecasting & Real Revenue Reports

→ Batch Invoicing

→ Sales Analysis

→ Automatic Interest Calculation

→ Perform Bank Reconciliation

→ Useful Accounting Reports

→ Create Recurring Credits & Purchase Orders

→ Document Capture

→ Commission Management

→ Multi-Currency Options

→ Balance Sheet, Profit & Loss and Trial Balance Reports

Ease Of Use

The core aim of any good accounting software is to simplify your accounting and bookkeeping tasks. User-friendly software, with an easy-to-navigate interface, reduces the learning curve, allowing you to spend less time training, and more time focused on your business.

While you may have a dedicated accountant or bookkeeper using the software, as an owner you’d want to have the ability to login and browse your books, which is why functionality should be intuitive.

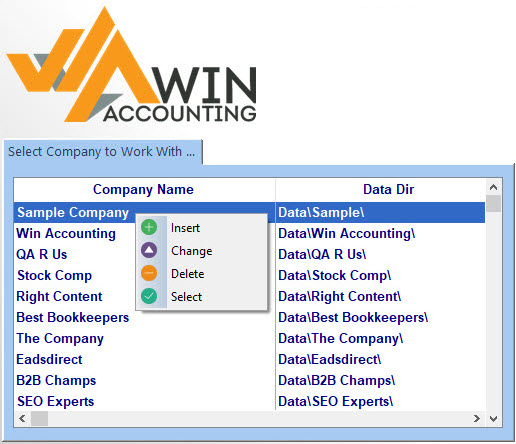

A key feature that many business owners and bookkeepers come to Win Accounting looking for is the ability to easily manage and control team collaboration tasks and processes.

When working on collaboration tasks, or if third party accountants or bookkeepers have access to your accounting software, it’s important to research what sort of access limitation controls are available.

The right accounting software should allow you to manage hierarchical user security levels that let you fine-tune which accounts and companies each new user can view.

Common Sources of Dissatisfaction among Small Business Accounting Software Applications

Security – Is My Software Secure?

As you’ll be working with sensitive business data, understanding the security and backup capabilities presented with each accounting software option is paramount.

You want to find a company that is upfront and clear about their software security, as this helps show that they have nothing to hide.

Small business accounting software will typically keep your content safe by encrypting your data.

While it’s important to educate your users about general internet security and keeping confidential data safe, admins should typically be able to quickly and easily view and edit restrictions and access rights of all users.

When choosing the best accounting software for your business, it’s also vital to understand the data backup options offered – and what processes are available for restoring a backup should data be lost.

A good accounting software solution will typically cater for both manual and automatic backups, make it easy to select a source directory, automatically include the date and time of each backup, and give you the option to configure the process depending on your accounting needs.

Many of the top accounting software packages will provide you with a recommended backup solution that is clearly defined for your ease.

Scalability – Will Software Grow With My Business?

You don’t want to be held back by your accounting software down the line, which is why it’s crucial to choose a solution that has the potential to grow with your business.

Having to migrate data to a whole new system once you outgrow yours can be painful – and expensive!

View the various pricing plans available for the different accounting packages – take note of any additional costs involved in unlocking add-on features that you may require in the future.

Having the ability to easily add additional users and companies to your accounting software is another important factor to consider when assessing scalability.

Research the steps that you’ll have to take when the time comes to integrate new features into your existing software – the ideal accounting software should have modules that integrate seamlessly, making it a quick and hassle-free process.

Another great way to evaluate the scalability of a potential accounting software is by spending some time researching the company behind the program. Are they actively working on upgrades and new features? Is there a way to request custom features? Do they provide high quality customer support? Are they proud of the product that they’re selling?

Insert Additional Companies and Users with Ease

Real-Time Accounting Reports

Having the right accounting reports at your disposal can provide you with the crucial information required to make the absolute best strategic and financial decisions for your company.

Choosing an accounting software that makes it easier for you to visualise and understand your comprehensive business data is important, as the benefits are endless!

Accounting reports that you should typically look out for in your prospective software include:

Sales Analysis Reports, often built using Product Analysis, Customer Analysis and Sales Team Analysis – Explore the endless benefits of the sales analysis report.

Creditor Analysis Reports, which often include Purchase Analysis and Age Analysis reports.

Chart of Accounts Report, a logically structured listing of every account – the proverbial “big picture” of business financial health.

Detailed Posting Report, which provides a detailed report on every business transaction posted for the selected accounting period.

Trial Balance Report, a must-have when verifying the accuracy of your books (and identifying any errors).

Stock Management Reports, which may typically include ABC Analysis, stock over sales inventory turnover reports, as well as the slow moving inventory report.

Budget Forecasting Report, as well as Real Revenue Reports for smarter cash flow management, helping you to improve cash flow for your business.

Customer Support Quality

Post-sale customer support quality is vitally important, and one of the most overlooked things when selecting a new accounting software for your business.

Regardless of how easy or powerful the software is, you’ll likely require support at some point – when you have a problem, you want prompt and concise service.

Top business accounting software providers will be serious about customer support, offering help through various channels such as: online, email, telephone, via their software, through video tutorials, blogs, social media, FAQ, forums and more.

Be wary of accounting software providers that don’t supply support numbers or email listings online, as this may suggest that they don’t want you to contact them after a sale or that they’re not committed to helping you once they’ve already dipped into your wallet.

An easy way to test the support quality is by sending a message, or phoning their support number to see how they respond, as well as how long it takes to hear back.

Try Before You Commit

Many of the best small business accounting packages make it possible for you to try out the software freely before you decide to commit.

This is great, as it allows you to get familiar with the product – and decide whether it’s the perfect fit for your business – before any money leaves your pocket.

Most popular accounting software options will provide a free trial period, giving you a set amount of days to try the product with no strings attached, before it locks you out and pushes you to pay.

This provides the perfect time to test the interface, usability and all-round ease of use.

Other solutions may offer the full solution, with no license expiry, instead opting to attach an additional fee for each new user added. This solution often works best for many small businesses, as most will only have one user working with the software anyway.

This allows them to unlock the full power of the accounting software, without even denting their budget.

If the accounting software does its job and effectively saves you time and money, when the day comes to expand, you’ll rest easy knowing that you have the option easily available to you, without having to migrate all your current data to a whole new, bigger system.

Conclusion

The right small business accounting software will help simplify and automate your accounting and bookkeeping tasks, drastically reducing human errors in calculations and the amount of time and resources spent on managing the financial health of your company.

An ideal accounting software solution will evolve with your business, becoming an integral part of every financial decision you make.

While there are many factors to consider, choosing the right accounting software for your small business doesn’t have to be a difficult task.

It’s easy to feel crippled by choice, but by asking the right questions, and answering them as accurately as possible, you’ll be able to narrow down the list and find a solution that is perfect for you.

While every business is unique, and will therefore require different capabilities, some important factors to keep in mind include software features, price, scalability, ease of use, security and customer support quality, just to name a few.

By planning ahead, clearly defining your accounting needs and doing a basic cost-benefit analysis, you’ll be able to identify an accounting software program that perfectly serves your needs.

(Last Updated: 13 May, 2020)

Read your post. I wanted to ask you something though… What’s the best way to learn how to be successful as a business owner? There’s so much to learn and I’m getting conflicting information when I research. Thanks in advance for your answer. 🙂

Everything is very open with a precise explanation of the issues.

It was really informative. Your website is useful.

Thank you for sharing!

Amazing information you have shared in this article. This article helps me a lot and also I found some unknown information in this article. Thank you for the information.

There is definately a great deal to find out about this subject.

I really like all of the points you have made.